Trading on the stock market always has some degree of risk involved, especially with short-selling. If you have your money tied up in a certain stock, there’s always a chance that a company’s fortunes will fall and leave you facing less than stellar results.

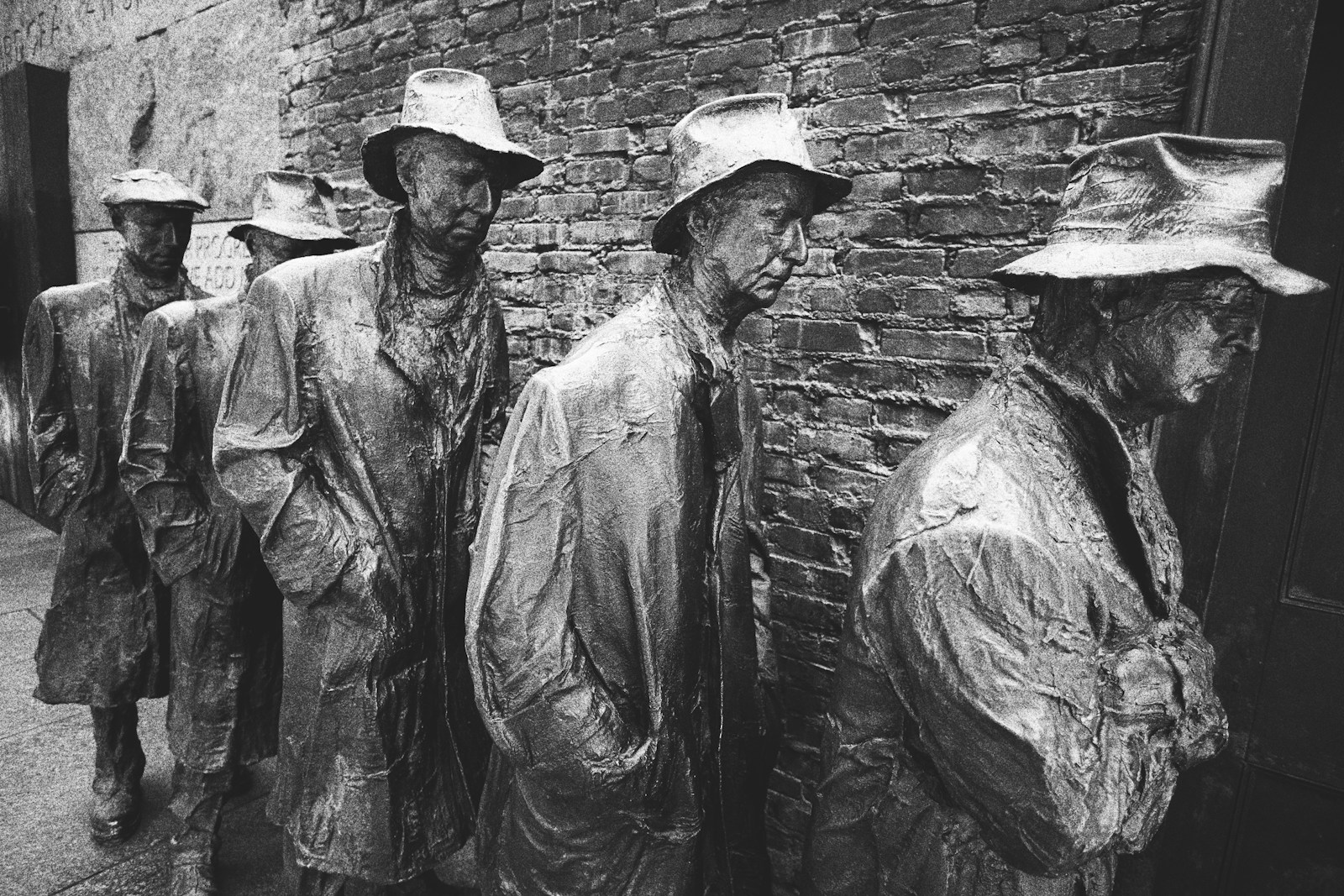

But what if the stock market as a whole crashes? It’s happened before, most recently with the Great Recession at the end of the previous decade. Previous stock market crashes can provide us a great source of knowledge and information when it comes to understanding this part of the financial sector.

How does a stock market crash, and what are the potential warning signs? Read on and we’ll walk you through everything you should know.

How Does A Stock Market Crash?

Looking at the stock market crashes of the previous years, we can easily find evidence of trends that contribute to stock market crashes. Commonalities between recorded stock market crashes include overvalued markets, financial engineering, and external catalysts such as a terrorist attack or a natural disaster.

Overvalue

If we look at the previous crash, The Great Recession, you’ll notice that the market was overvalued leading up to the crash. The best indicator of the market’s value can usually be found by looking at the price-to-earnings ratio. This can be found by dividing the total price of the stock market by all of the company’s earnings.

More than likely, you’ll find that the stock market is currently overvalued. A market can stay overvalued for long periods of time before it eventually crashes. This overvalue is a huge contributor to an eventual crash, but it isn’t always the best sign that a crash is coming soon.

Financial Engineering

If you know anything about the Great Recession, it’s probably that it was triggered by a bubble bursting in the housing market. Mispriced mortgage securities pressured the market into eventual collapse.

This is similar to what happened to the dot com crash in 2000, where investors poured far too much money into tech-related stocks. Irresponsible or irrational behavior by investors can help to create an environment where a crash is likely.

External Forces

Sometimes it’s factors not even directly related to the economy that can trigger a crash. Any event large enough to shake consumer confidence can cause people to run and retrieve their money and trigger massive instability.

The famous Black Monday crash of 1987 was initially triggered by the Iran War, for example. Earlier crashes, like the one that struck the United States in 1907, were actually spurred on by fear over massive earthquakes.

It’s hard to predict such events. The surprising or unpredictable nature of these events are a big part of why they have such a large impact on the market.

Learning From Stock Market Crashes

How does a stock market crash? Looking to history can help us see signs and symptoms of potential crashes in the modern-day.

Leave a Reply